Solar Incentive Calculator

Homeowner Script:

The government is giving away money to go solar!

Up to 80% can be reimbursed via IRS refund.

Let's uncover how much you qualify for before they expire!

- Lifetime Energy

Expenses - vs.

- Energy Banking™

Savings - Today

- vs.

- Year 5

- vs.

- Year 10

- vs.

- Year 25

- vs.

- Year 50

- vs.

- Year 75

- vs.

- Year 100

- vs.

| Energy Expenses | ||||||

| Inflation Rate | Electric Bill (MO) | Electric Bill | Auto-Fuel Bill | Total Energy Bill | Cumulative Energy Bill | |

| Monthly | ||||||

| Annual | ||||||

| Energy Savings | Energy Banking | |||||

| Connection Fee | Solar Bill | Cumulative Solar Bill | Solar Savings | Annual ROI | Investment Rate of Return | |

| Monthly | ||||||

| Annual | ||||||

Got Questions?

Book A "Phone A Friend" Call

All calls are recorded for compliance purposes.

3-Minute Homeowner Story

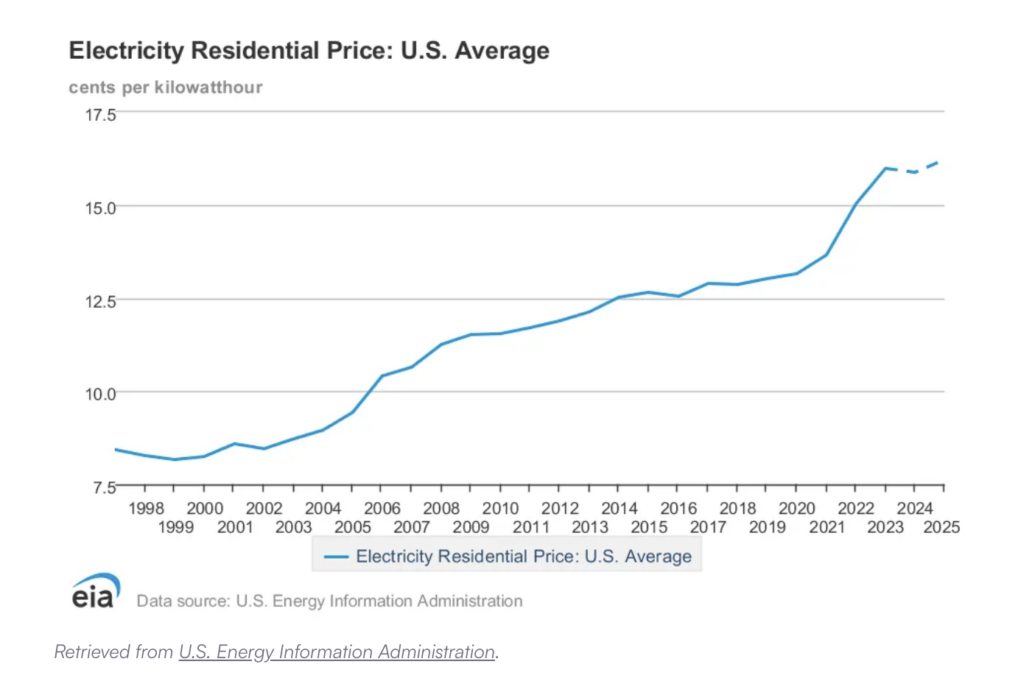

2022 Energy Inflation Up 14.3%

ENERGY BANKING™ SCRIPT:

Explain the Problem:

- Have you ever estimated how much money you will spend on electricity and auto-fuel over your lifetime?

- Since we all need electricity to live, we typically just pay the bill.

- But now we can eliminate energy expenses with solar and even a new Electric Vehicle.

- Let’s calculate your lifetime energy expenses and agree on the number together. OK?

- How much do you spend per month on electricity? And Auto-fuel?

- The average inflation on energy is about 5%. Is that fair to say?

- Let’s focus on the red column by year. Do these numbers make sense?

- Do you think this is a problem you want to fix?

Explain the Solution:

- What do you think would happen if we invested these monthly energy savings?

- The S&P 500 index has averaged 12% over the last 50 years.

- Can we use this number as your investment rate or would you rather buy bitcoin which averages 35%?

- Do you think the annual solar savings look accurate?

- Can you see how the savings compound over time?

- Do you understand the numbers?

- Great! So let’s get the compound effect started for your future!

Report A Sale

SMS / Email to Client:

SMS:

Dear {{contact.name}},

Congratulations on going solar from Solar Tax Pros!

Your solar rep engaged our tax firm to help you maximize your solar incentives.

Please check your email for further instructions.

Solar Tax Pros

(302) 829-7767

Email:

Dear {{contact.name}},

Congratulations on going solar from Solar Tax Pros!Your solar representative {{contact.solar_pro_first_name}} {{contact.solar_pro_last_name}} from {{contact.solar_pro_company_name}} engaged our tax firm to help you collect and maximize your solar incentives.

Our Solar Tax Max™ Plan will provide full documents with your IRS forms completed with expert detail.Please let us know the minute your solar system is installed.

To begin, save our number in your cell phone nowSolar Tax Pros

(302) 829-7767

A member of our team will reach out at the beginning of the New Year to collect the information needed to complete your Solar Tax Max™ Plan.

Please have this information handy at year’s end:

1. Solar Monitoring Login – to calculate total annual solar production in KwH.2. Solar Loan Contact Info – to calculate total loan interest paid.

3. Solar Contract – to confirm total solar costs.

4. Net Meter Agreement / Inter-Connection Agreement

5. Permission To Operate Certificate – Date Solar began producing energy to the grid.

6. Year-End Electric Bill – to calculate utility company price per KwH.

Please upload this information at https://SolarTaxPros.com/questions

Sincerely,Solar Tax Pros

(302) 829-7767

(302) TAX-PROS

SolarTaxPros.com

Book A Call for

Homeowners / CPAs

Calls Recorded For Compliance Purposes

Book A Call

Solar Pros Hotline

Calls Recorded For Compliance Purposes