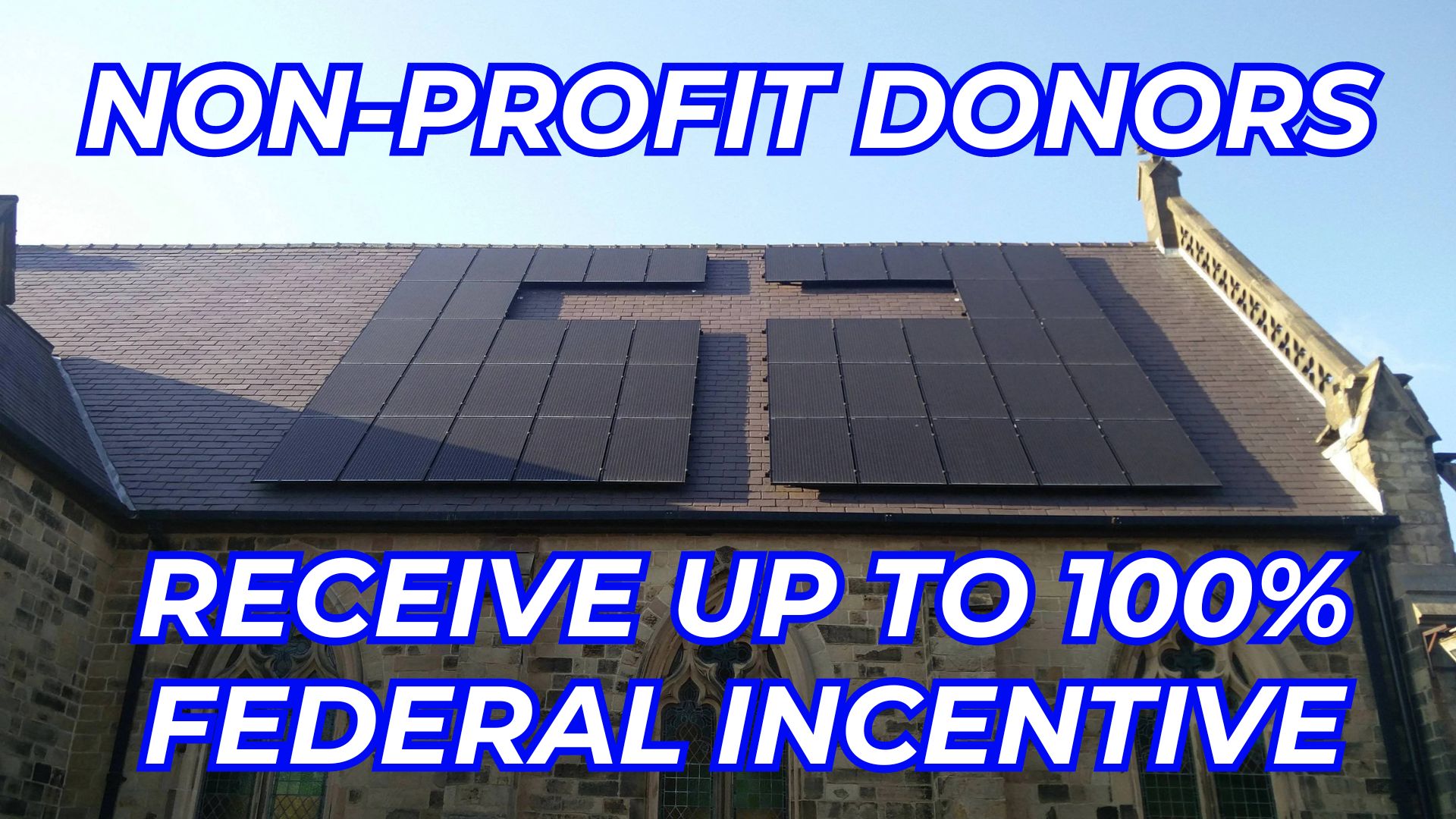

Non-Profits Win Big With Solar

Non-Profits and their donors can now win big with solar by eliminating electric bills and having the government help cover most of the solar investment.

The new Inflation Reduction Act offers Non-Profits a 30% Direct Pay Reimbursement from the Treasury Department to help cover solar investment costs.

However, Solar Tax Pros developed a more powerful way Non-Profits and their donors can use to reap even more than the 30% tax credit.

A high-income taxpayer, possibly related to the non-profit can purchase the solar system for the non-profit to reap all the tax benefits that include:

30% Tax Credit

30% Tax Deduction

10% Energy Community Tax Credit

10% Domestic Content Tax Credit

Additional State, Local & Utility Incentives

Nearly 100% of the costs can be reimbursed to the Donor.