If you Invested In a Solar System...

Discover the Extra Solar Incentives We Can Get you with our

solar tax max™ plan!

Problems

- No Solar Tax Guidance

- Tax Preparers Not Solar Experts

- Tax Preparers Miss Extra Incentives

- Homeowners Misinformed About Solar Refunds

Solutions

- We Provide Free Solar Tax Guidance

- We Are Clean Energy Tax Law Experts

- We Collect Extra Solar Incentives

- We Provide Tax Refund Timing Analysis

Solar Tax Pros is a premier tax consulting firm, comprised by a team of CPAs and Tax Attorneys who specialize in advanced tax planning and energy incentive reimbursement strategies. Our proprietary strategies provide significant advantages for solar investors.

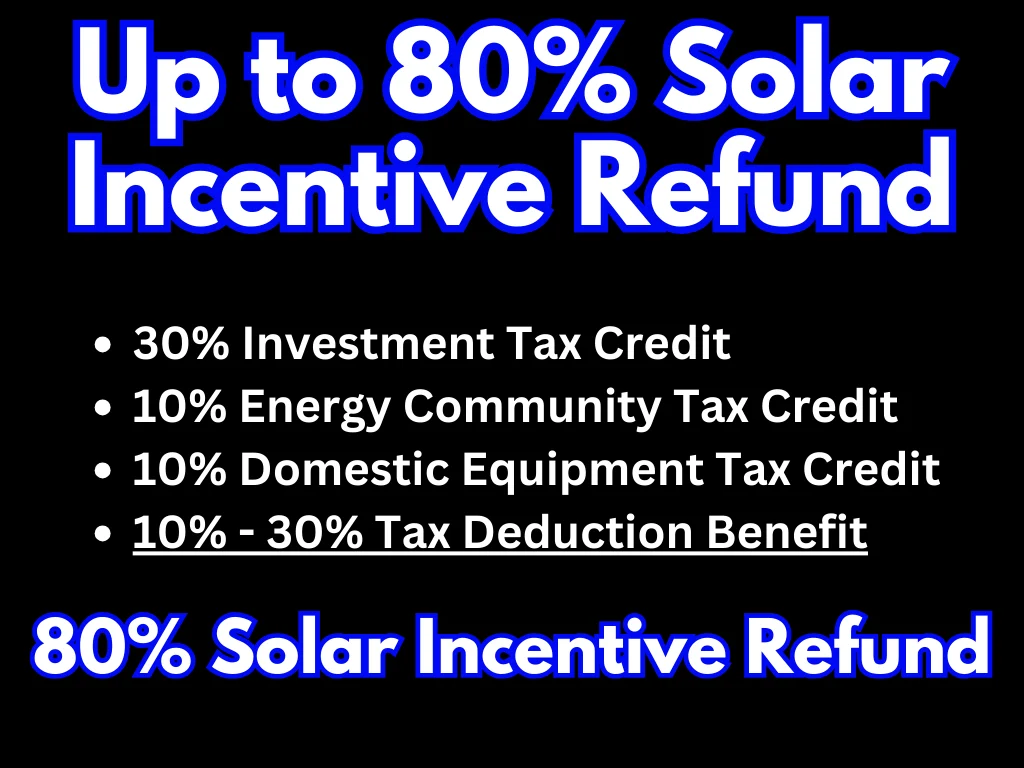

The Investment Tax Credit (ITC) provides a 30% income tax credit from the IRS to offset the costs of solar investments.

With our Solar Tax Max Plan™, investors can recoup an additional 10% to 40% in income tax incentives, alongside potential state, local, and utility incentives.

The Solar Tax Max™ Plan enables homeowners to receive additional federal income tax incentives ranging from 10% to 40% on top of the existing 30% Investment Tax Credit. The total amount recovered depends on the homeowner’s income and the solar project location.

The 30% Investment Tax Credit (ITC) is calculated based on the total investment in a solar system. As a non-refundable tax credit, it can only provide a refund if income taxes are being paid.

– If income taxes have been paid and a credit is available at the IRS, the IRS will refund the excess amount.

– If the entire tax credit is not used in the first year, the remaining balance can be carried forward to the next year or carried backward up to three years.

– The tax credit balance can be carried forward for up to 20 years or collected from taxes already paid.

Example:

– In 2024, a homeowner invests $100,000 in a solar system.

– The homeowner receives a 30% ITC, equating to $30,000 from the IRS.

– The homeowner, who is married and earns $100,000 paying $20,000 in taxes.

– The homeowner will receive a $20,000 tax refund.

– The remaining $10,000 tax credit can be collected from taxes paid in 2023 or carried forward for the next years tax liability.

According to new IRS rules, a solar system must be active and producing energy to qualify for solar incentives.

Example:

– A homeowner signs a contract to purchase a solar system on January 1, 2024.

– The homeowner can apply for the solar incentives after the 2024 tax year is complete.

Our extensive research into solar tax incentives would take other CPAs countless hours to complete.

Solar Tax Pros has done all the homework for your current tax professional to apply to your tax filing. Additionally, we offer the option to have your taxes filed by our expert tax team.

Our fee represents a small fraction of the substantial income tax savings and refunds you’ll receive.

Absolutely! A solar tax credit can be used to pay back taxes owed.

Each person’s tax situation is different but our Solar Tax Max™ Calculator is precise.

In the event of an audit concerning our solar incentive work, our tax team will defend you at no additional cost.

Yes! Solar Tax Max™ can be applied to solar investments made up to three years ago.

Yes, Solar Tax Pros has a large network of solar installers across the nation.

Haven't Gone Solar Yet?

That’s because you haven’t seen our irresistible solar proposal!