Our Energy Banking Plan™

Creates Massive Wealth

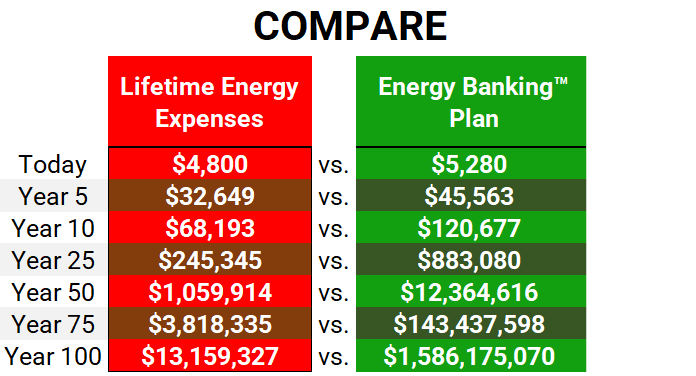

Energy Banking™ is a new concept that estimates and compares one’s lifetime energy expenses versus investing the monthly solar savings into an investment account over time.

The result is the immediate need to create the compounding effect that Albert Einstein coined the “Eighth Wonder of the World.”

- High Income Returns

- Energy Banking™ & Solar Tax Max Plan™

- Designer Solar Roof Options

- Expert Energy & Roofing Consulting

- Full Disclosure

- Back-Up Power Options

- Solar Maintenance Plans

Lifetime Energy Expenses Assumptions:

$200 Electric Bill

$200 Auto-Fuel Bill

5% Inflation Rate

Energy Banking™ Plan Assumptions:

Request A New

solar Energy plan

When you deal with Solar Tax Pros you receive 100% disclosure on all the facts about solar from a trusted authority.

We’ve mastered solar incentive maximization strategies to create unbeatable solar proposals.

We are aligned with the highest quality solar installers in the country to minimize construction headaches.

We look forward to discussing your custom solar plan with you.

Frequently Asked Questions

Solar Tax Pros is a tax consulting firm with a team of Certified Public Accounts and Tax Attorneys specializing in solar tax incentives creating multiple proprietary solar strategies to help solar investors win big.

Solar Tax Professionals will ensure all your IRS forms are filed out correctly so you can recoup the maximum solar incentives available by law.

The 30% investment tax credit is calculated based on the total Solar System costs.

The investment tax credit is a non-refundable tax credit meaning a refund is only given if one is paying income taxes.

- If you paid income taxes and you have a credit at the IRS, the IRS will refund the extra money you gave them.

- If you don’t use the entire tax credit in the first year, you can use the remaining credit balance next year.

- The tax credit balance will carry forward for 20 years.

Higher Income Taxpayer Example:

A Homeowner goes solar and pays $100,000 for a solar system in 2023.

The Homeowner receives a 30% Investment Tax Credit of $30,000 from the IRS.

The Homeowner is married and earns $100,000 in 2023 and pays $20,000 in taxes.

The Homeowner will receive a $20,000 tax refund.

The remaining $10,000 tax credit will carry forward for 20 more years.

Lower Income Taxpayer Example:

A Homeowner goes solar and pays $100,000 for a solar system in 2023.

The Homeowner receives a 30% Investment Tax Credit of $30,000 from the IRS.

The Homeowner is married and only earns $50,000 in 2023 and pays just $3,000 in taxes.

The Homeowner will receive a $3,000 tax refund.

The remaining $27,000 tax credit will carry forward for 20 more years.

ZERO Income Taxpayer Example:

A Homeowner goes solar and pays $100,000 for a solar system in 2023.

The Homeowner receives a 30% Investment Tax Credit of $30,000 from the IRS.

The Homeowner is married and only earns $30,000 in 2023 and pays just $0 in taxes.

The Homeowner will receive NO tax refund.

The remaining $30,000 tax credit will carry forward for 20 more years.

The Solar Tax Max™ Plan allows homeowners to receive additional Federal income tax incentives of 10%-40% above the 30% Tax Credit.

Depending on how much income tax you pay, solar incentives may be fully collected back in the first year for higher-income earners or a series of years for lower-income earners- until realized. Proper tax planning is required!

Yes! A tax solar credit can be used to pay taxes owed one year prior.