Learn To Master

Solar inCentive maximization Strategies

From THe Solar incentive authority

Free Solar Tax Max™

Certification Course

Solar Tax Max™ Course

Onboarding Call

3rd

Field Training

GOT QUESTIONS?

stay up to date on the latest

SOLAR INCENTIVE news

Wednesdays

4 pm EASTERN TIME

- 10%-40% Above 30% Tax Credit

- Achieve 100 Solar Sales Month

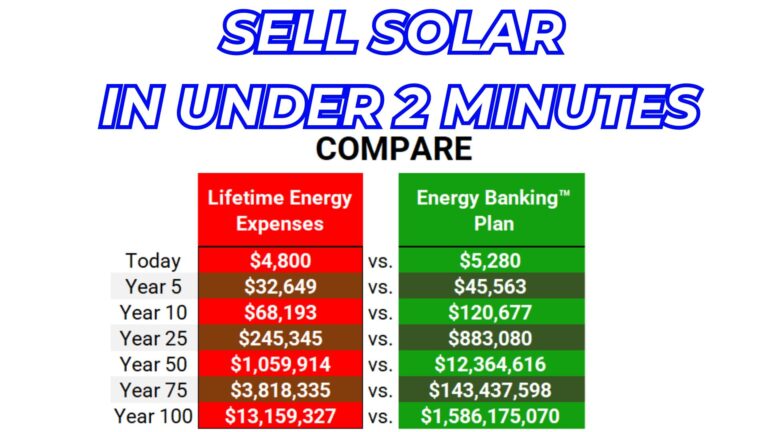

- Sell Solar in Under 2 Minutes

- Eliminate Dealer Fees

- 75% Battery Reimbursement

- Non-Profit Reimbursement Plan

- Tax Planning for Solar Installers

- Reflective Roof Tax Credits

- Roofer to Solar Program

- Approved by Solo

- Structured by Harvard Law Team

- Mandatory Industry Training Course

- On-Demand Solar Rep Hotline (Phone A Friend)

- On-Demand Homeowner Hotline

- Weekly Training Webinars

- Simple Solar Tax Max™ Calculator

- Energy Banking™ Plan Calculator

- Tax Return Filing

- Commercial Sales Help

- Previous Solar Sales Experience

- Race to 100 Sales Month Program

- Tax Credit Transfers

- Income Tax Elimination Planning

Solar Tax Max™ Uses

New Solar Sales

Solar Pros instantly drop net solar costs

for homeowners paying income taxes!

- Lower Solar Cost

- Increase Sales

- Destroy Competition

Missed Solar Sales

Revisit prospects that didn't close and show them a new solar offer!

- New Pricing

- New Story

- New Sales

Past Solar Sales

Homeowners can go back back three years to collect missed incentives!

- Use On Past Sales

- Create Referrals

- New Reviews

Let Our

Solar Tax Team

Be Your Guide

10,000+ Homeowners Received Extra Solar Incentives

100%

Satisfied

Solar Customers

Solar Tax Max™

Makes Gold!

At Solar Tax Pros, we’re not your typical tax consulting firm.

We specialize in pioneering strategies that merge renewable energy with expert tax reduction planning.

Behind our innovative thinking are a group of accomplished Harvard Tax Law Attorneys, CPAs, and Solar Industry Pros, whose combined expertise has led us to develop a suite of groundbreaking solar industry solutions, including:

Solar Tax Max™ Plan: Allows homeowners to collect up to a staggering 70% in federal solar incentives from the IRS.

Energy Banking Plan Calculator: Show prospects how to “Go Solar” in 2 minutes.

Commercial Solar Incentive Guidance: Stop losing bids to inexperienced clients’ CPAs.

Battery Reimbursement Plan: Explore a nearly 75% battery reimbursement plan.

Non-Profit Reimbursement Plan: Unlock up to 100% reimbursements for non-profit organizations.

Strategic Roofing Tax Credits: Secure extra tax credits for reflective roof coatings and bi-facial modules.

Income Tax Elimination Plan: Effortlessly reduce income tax liabilities with our expert tax planners.

New Solar Scripts!

- 1. “I CAN GET YOU 10%-40% EXTRA - ON TOP OF THE 30%!” - Solar Tax Max™ Plan

- 2. “SOLAR CAN SAVE YOU MILLIONS FOR RETIREMENT!” - Energy Banking Plan

- 3. “I CAN GET YOU A NEW BATTERY NEARLY 75% REIMBURSED!” - Battery Reimbursement Plan

- 4. “I CAN ELIMINATE YOUR INCOME TAXES?” - Tax Elimination Planning

- 5. “MY SOLAR TEAM FINANCIALLY ENGINEER PLANS TO MAKE SOLAR IRRESITABLE!” - Commercial Solar Planning

Frequently Asked Questions

Solar Tax Pros is a tax consulting firm with a team of Certified Public Accounts and Tax Attorneys specializing in energy incentive reimbursement programs . We have created many proprietary strategies to help solar investors win big.

The Solar Tax Max™ Plan allows homeowners to receive additional Federal income tax incentives of 10%-40% above the 30% Tax Credit.

Depending on how much income tax you pay, solar incentives may be fully collected back in the first year for higher-income earners or a series of years for lower-income earners- until realized. Proper tax planning is required!

Our fee is a small fraction of your newfound income tax savings.

Each person’s tax situation is different but our Solar Tax Max™ calculator estimates solar incentives very accurately.

If you are ever audited our Tax Attorneys and CPAs will defend you in tax court at no cost to you whatsoever and we put this in writing.

30-Minute

Solar Tax Max™ Class

Solar Tax Max™ Calculator

3

Weekly Trainings

& Win More Sales